Fed Warns Of Stagflation: What Trump’s Tariffs And Rising Prices Mean For Your Nest Egg – Financial Freedom Countdown

On Inauguration Day, the U.S. economy looked like the envy of the world; strong corporate profits, low unemployment, and robust consumer demand.

But those bright spots are now dimming.

Newly released minutes from the May 6-7 Fed meeting indicate that Federal Reserve officials are signaling concern.

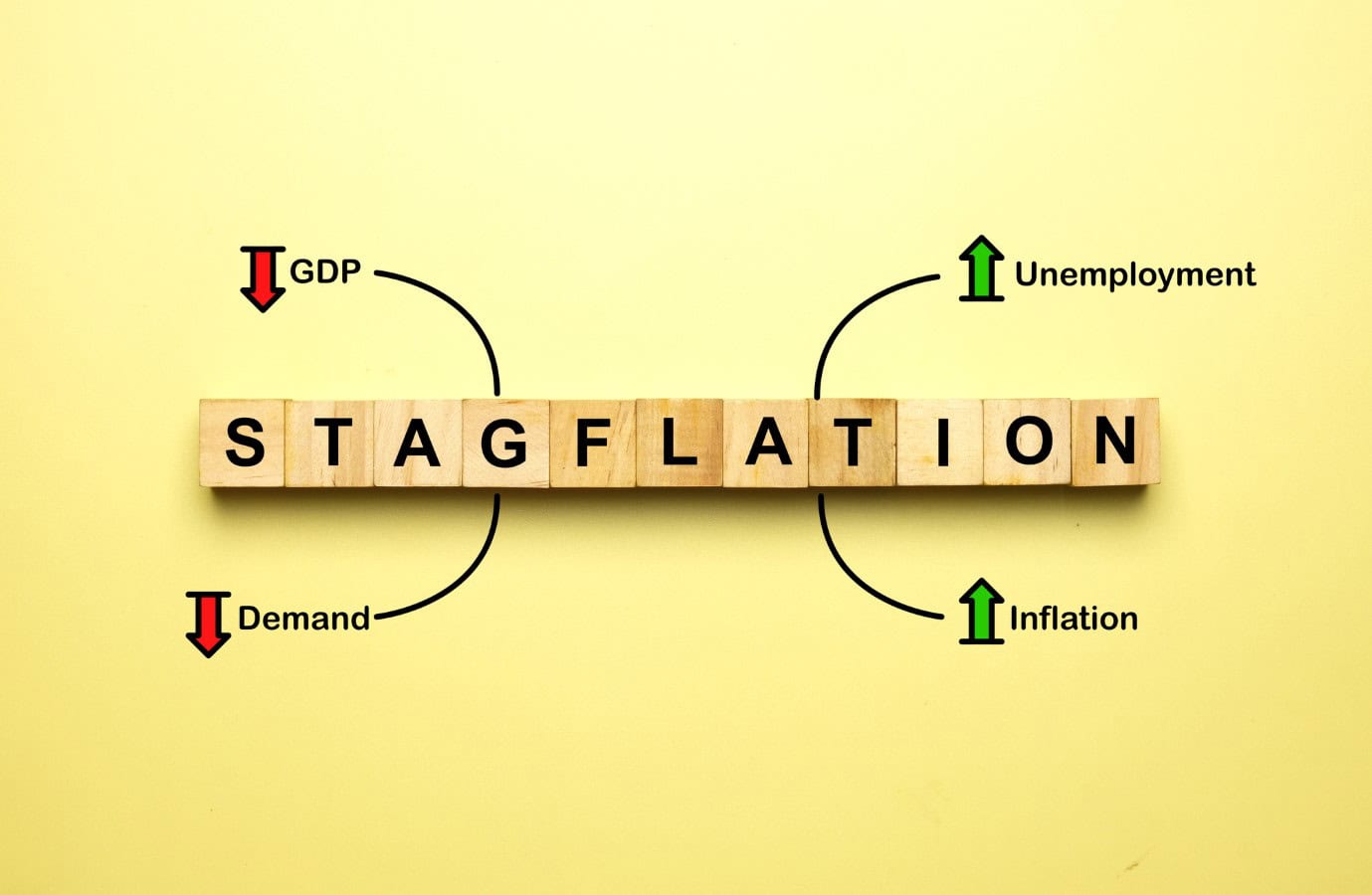

A troubling economic double-whammy is taking shape: stubbornly high inflation combined with weakening growth. In other words, stagflation; a term many Americans haven’t heard since the 1970s is back in the national conversation.

A Fed Caught in the Middle

“Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer,” said the Fed meeting minutes.

At the heart of the storm is the Federal Reserve, the institution responsible for keeping inflation in check while sustaining economic growth.

Fed officials have grown increasingly alarmed by recent economic data.

Inflation has proven more persistent than expected, and signs of economic cooling are hard to ignore.

The minutes from the Federal Reserve’s most recent meetings show deep concern about the economy’s direction.

Some officials warned that if inflation continues to hover above 3% and labor markets soften, the Fed could be forced into a no-win situation: raising rates and worsening a slowdown, or cutting them and reigniting inflation.

Monetary Policy Gridlock

Normally, the Fed would react to slowing growth by lowering interest rates.

But with inflation still running above the 2% target, the central bank is handcuffed. Interest rates remain at restrictive levels, yet inflation expectations are rising again; partly because of tariffs, which artificially raise prices.

Investors have priced in the likelihood that rates will stay high for the foreseeable future.

Hopes for an interest rate cut at the Fed’s upcoming mid-June meeting have faded after Chair Jerome Powell remarked that the risks of holding steady to assess economic conditions were “fairly low.” Since then, Fed officials have echoed his stance, signaling that the central bank is unlikely to ease rates without clear signs of further economic deterioration.

Rates Stuck at a High Level

Since the Fed’s last meeting, former President Trump agreed to reduce tariffs on Chinese imports from 145% to 30%, easing tensions with Beijing and calming jittery investors who feared an economic downturn that might force the Fed’s hand on rate cuts.

Markets now anticipate the Fed will keep interest rates unchanged through the summer.

Last year, the Fed cut its benchmark rate by one percentage point to approximately 4.3% as inflation cooled and unemployment edged higher after previously raising rates to their highest level in two decades during 2022 and 2023 to combat surging prices.

Fed Economists Cut Growth Outlook Amid Trade Policy Turmoil

Recent trade-policy announcements have led the Federal Reserve’s staff economists to downgrade their forecasts for economic growth in both 2025 and 2026, compared with projections made in March.

As a consequence, they now expect the labor market to “weaken substantially” through the remainder of the year, with unemployment rising and staying elevated well into 2027.

A Silent Threat to Retirement Portfolios

For older Americans, the timing couldn’t be worse.

Retirement portfolios, many of which rely on bonds and stocks, are sensitive to both high inflation and weak growth.

Inflation eats away at purchasing power, while stagnation curbs stock market returns.

Worse, stagflation often prompts erratic policy responses; everything from price controls to capital restrictions further unsettling markets.

That uncertainty has already begun to erode the confidence of investors and financial planners alike.

How Tariffs Compound the Problem

While the Fed fights inflation with interest rates, the Trump administration is amplifying it with trade barriers.

Hundreds of tariffs, often imposed with little warning could ripple through supply chains and boost prices for everything from vehicles to food.

Unlike a temporary oil shock, tariffs are policy choices and can be reversed. But uncertainty about their duration and scope discourages investment and planning.

Businesses don’t want to commit capital to factories that may lose protection overnight. As a result, productivity suffers, prices rise, and consumers bear the cost.

Court Blocks Trump’s Broad Tariffs, But Business Uncertainty Remains

A federal court on Wednesday struck down many of the sweeping tariffs imposed by President Trump on nearly all U.S. trading partners, ruling that the president had overstepped his legal authority.

The U.S. Court of International Trade suspended the 10% tariffs Trump introduced on “Liberation Day,” along with additional levies targeting China, Mexico, and Canada.

While the decision offers temporary relief, it has done little to ease the broader uncertainty gripping the business community.

With policy reversals and abrupt trade moves still a real possibility, many companies remain hesitant to make major investment or hiring decisions in such an unpredictable environment.

What Americans Can Do to Prepare

While individuals can’t control Fed policy or White House tariffs, they can take steps to shield themselves from the worst effects of stagflation. Here are a few time-tested strategies:

Diversify Income Sources

In an inflationary environment, fixed incomes lose value quickly.

Consider adding dividend stocks, inflation-protected bonds (like TIPS), or even rental income to your portfolio.

These can offer some insulation against rising prices.

Evaluate Spending and Budgets

With prices rising unevenly across sectors, older Americans should take stock of their biggest expenses. Energy, food, and medical costs are often the first to spike.

Building a more resilient budget now can prevent hardship later.

If you do not already have a budget, use free software like Personal Capital from Empower which can analyze your current spending and create a budget based on it.

Delay Major Financial Moves

Now is not the time to rush into buying a new home, refinancing a mortgage, or cashing out retirement funds unless absolutely necessary.

With interest rates elevated and markets unstable, patience may pay off.

Prioritize paying down high interest rate debt and have an adequate emergency fund as a safety net.

Stay Informed on Policy Changes

Economic conditions can shift quickly in response to government actions.

Pay attention to Federal Reserve statements, tariff announcements, and inflation reports.

If Trump pushes for Fed interference or sudden capital controls, the financial consequences could be dramatic.

Avoid Panic Selling

Stagflation-era markets are volatile but not hopeless. Selling assets during a downturn can lock in losses.

Many retirement accounts are built for long-term horizons. Staying invested and focusing on quality assets can make a big difference.

A Warning from the Fed: Trust Must Be Earned

Fed Chair Jerome Powell has so far resisted Trump’s political pressure to cut rates prematurely, but that resistance may not last forever.

If the central bank loses its independence, financial markets could panic. That would mean higher borrowing costs, a falling dollar, and accelerating inflation; a perfect stagflation storm.

Trust, once lost, is hard to recover. Investors remember the 1970s. Back then, Fed credibility collapsed, and inflation didn’t peak until interest rates topped 20%.

A return to that world would be devastating for today’s retirees.

A Future Worth Fighting For

The Fed cannot fix everything. Much of today’s stagflation risk is driven by fiscal and trade policies beyond its control.

Still, maintaining monetary discipline is essential. Powell and his colleagues must continue walking a tightrope; tightening where needed, but resisting the urge to react to every political whim.

This Time Is Different And the Same

Today’s economic woes are driven by different forces than the 1970s, but the risks are eerily similar. Political volatility, price shocks, and central bank dilemmas are a dangerous mix.

If uncertainty continues for American businesses, the next chapter may be written not by policymakers; but by markets, savers, and retirees left to pick up the pieces.

Like Financial Freedom Countdown content? Be sure to follow us!

During his 2024 campaign, Donald Trump pledged that seniors would no longer pay taxes on their Social Security benefits. But that promise is notably absent in the new Republican tax bill making its way through Congress. The One Big Beautiful Bill Act; named after one of President Donald Trump’s signature phrases fulfills several of his campaign pledges, including a temporary end to taxes on tips and overtime pay. However, it stops short of eliminating taxes on Social Security benefits, a key demand from many seniors. Still, the bill offers some tax relief for older Americans through other measures.

Trump’s Social Security Tax Cut Stalls Amid Senate Roadblocks

GOP Passes Trump’s Education Overhaul and Student Loan Plan as Critics Cry Foul

A sweeping Republican-backed education and tax bill, endorsed by Donald Trump and recently passed by the House, promises to overhaul the U.S. student loan system and financial aid programs. Branded by some conservatives as a long-overdue reform, critics warn the plan could upend college affordability for millions; especially low-income families, graduate students, and current borrowers. We break down what the bill includes; and what it could mean for students, parents, and universities.

GOP Passes Trump’s Education Overhaul and Student Loan Plan as Critics Cry Foul

Trump’s Education Dept Rakes in $100 Million From Defaulted Student Loans as Advocates Slam ‘Aggressive’ Collections

Federal student loan collections resumed at the start of May, and the Treasury Department has wasted no time ramping up enforcement. According to Education Secretary Linda McMahon, nearly $100 million has already been recovered from defaulted borrowers through a mix of loan consolidations, rehabilitations, and intercepted tax refunds. McMahon disclosed the figure during a recent budget hearing before the House Appropriations Committee, signaling a strong and swift return to aggressive collection tactics.

Trump-Branded ‘MAGA Accounts’ Spark Political Fight But Financial Experts Say Stick With 529s for Your Kids

Tucked inside the Republican Party’s sweeping “one big beautiful bill,” which cleared the House early Thursday, is a pilot program to launch new tax-advantaged investment accounts for newborns. Each child born during a second Trump term would automatically receive a $1,000 government-funded deposit. Initially dubbed “MAGA accounts”; short for “Money Account for Growth and Advancement”, the name was a not-so-subtle nod to Trump’s iconic slogan. But in a last-minute amendment, House Republicans took it one step further, voting to officially brand the accounts with the president’s name.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.